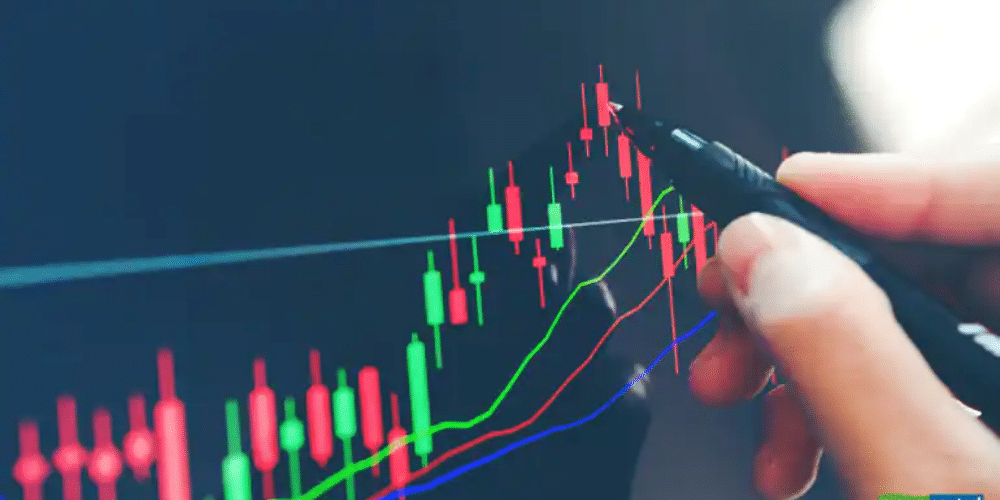

Are you looking for the best options trading alert services to take your investments to the next level? The stock market can be a tricky business, but with the right tools and resources, you can make wise decisions that will pay off in the long run. In this article, we’ll be discussing the top five best options trading alert services currently available – Sky View Trading, Mindful Trader, Benzinga Pro, OptionAlarm and Investopedia Stock Simulator. Each of these provide an options advisory service that can help you get ahead in the stock market. So let’s dive into each of them and find out what they have to offer.

1. Sky View Trading

Sky View Trading is a great options trading alert service for the sophisticated investor. They provide market analysis and recommendations in real-time so that you can make informed decisions on your trades. With this service, you will have access to their professional traders who are experts in the stock and options markets. They also offer entry price, profit factor, and trade recommendations so that you can maximize your profits. Sky View Trading makes it easy to understand the basics of options trading, as well as providing insights into more advanced strategies. Their chat room feature allows investors to discuss their trading strategies and receive advice from other experienced traders.

Sky View Trading offers investors a great way to make informed decisions and maximize profits in the options trading market. With their professional traders, market analysis, trade recommendations and more, it is no wonder why they are quickly becoming a leader in the industry.

Track Record and Professional Traders

Sky View Trading has been providing traders with quality options trading alerts and market analysis since its inception. Their professional traders are highly experienced in the stock and options markets, possessing a deep knowledge of various trading strategies. This expertise allows them to provide investors with accurate trade recommendations that maximize profits while minimizing risk. With Sky View Trading’s track record, you can trust that their trades will help you succeed in the options trading market.

The professional traders at Sky View Trading have years of experience analyzing financial markets and executing profitable trades. They understand the importance of risk management and use multiple strategies to ensure that investors remain safe from potential losses. These strategies include swing trading, block trades, and actual trades – all designed to maximize profits while reducing risk.

Whether you are looking for entry price or profit factor recommendations or just want to learn more about options trading strategies, Sky View Trading’s professional traders have the answers you need. Investing in their service is a smart decision for anyone looking to make informed decisions in the stock and options markets.

Options Market and Swing Trades

Swing trading is a popular strategy for traders looking to capitalize on short-term market movements. This trading style involves buying and selling options contracts to take advantage of the price fluctuations in the market. Swing trades are often based on technical analysis, which looks at historical data to identify patterns that may indicate future trends. Traders use their analysis to determine when they should enter or exit a trade in order to maximize profits while minimizing risk.

Options markets provide investors with a range of different strategies and potential returns. Savvy traders can use swing trading to take advantage of small price movements over short periods of time, as well as utilize other strategies such as covered calls, spreads, and arbitrage. Properly executed swing trades can be profitable over the long-term, but it is important for investors to understand the basics before engaging in any type of options trading activity.

Entry Price and Profit Factor

One of the most important factors to consider when swing trading options is the entry price. This is the price at which you purchase your option contract and can have a major impact on the potential profits or losses you make. It is important to be mindful of the current market conditions and technical indicators before making any trades, as well as considering potential exit points prior to entering a position. Another important factor to consider when trading options is the profit factor. This is essentially a measure of how profitable a trade could potentially be, taking into account both gains and losses over time. It is important to understand these two critical factors before engaging in any type of options trading activity.

2. Mindful Trader

Mindful Trader is a sophisticated options trading alert service that can help traders make more informed decisions when entering and exiting trades. It provides users with real-time market updates, options trading strategies, trade recommendations, and access to a professional support team. The Mindful Trader platform also includes an easy-to-use trading chat feature, which allows users to discuss their trades with other members of the community. The platform also provides educational resources on the basics of options trading and different strategies to use when entering positions in the market. Additionally, Mindful Trader offers advanced analytics tools to monitor potential opportunities and track your trades over time. With its powerful features and experienced traders behind it, Mindful Trader is one of the best options trading alert services currently available.

Investment Advice and Financial Markets

Investment advice and financial markets are an important part of any investor’s portfolio. Making informed decisions about when to invest and how to invest can be challenging, especially in the ever-changing environment of the stock market. Having access to reliable investment advice from knowledgeable professionals is essential for successful investing. Financial markets provide investors with a wide array of investments, including stocks, bonds, mutual funds and more. These investments offer varying levels of risk and potential rewards that must be carefully evaluated before investing. Additionally, understanding how macroeconomic events may impact different sectors or asset classes is key for successful investing. With the right advice and knowledge, investors can develop a diversified portfolio that will help them achieve their long-term financial goals.

Trade Recommendations and Actual Trades

Trade recommendations and actual trades are essential elements of any successful options trading strategy. Trade recommendations refer to specific buy or sell signals given by a broker, analyst or other professional traders. These recommendations include entry price, the size of the position, and the exit point. Actual trades refer to the completion of these recommendations in the market, usually involving buying and selling options contracts. Professional traders utilize both trade recommendations and actual trades as part of their trading strategies. Options traders often use swing trading strategies that involve entering and exiting positions quickly in order to capitalize on short-term trends.

Additionally, some traders may opt for more long-term strategies such as block trades which involve larger positions held over longer periods of time. Understanding how trade recommendations and actual trades interact can help investors develop an effective options trading strategy that is tailored to their unique risk profile and investing goals.

Block Trades and Options Trades

Block trades and options trades are two common types of trading strategies used by investors to capitalize on short-term trends in the financial markets. Block trades refer to large orders, such as those placed by institutional investors, that involve the buying or selling of a large number of shares or contracts at one time. These kinds of transactions can be used to quickly enter and exit positions in volatile markets. Options trades involve the purchase or sale of options contracts which grant the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a certain timeframe. Both block trades and options trades are popular strategies employed by traders who wish to capitalize on short-term price movements and rapid market fluctuations. Understanding how these two strategies work and their associated risks can help investors develop an effective trading plan tailored to their individual needs.

3. Benzinga Pro

Benzinga Pro is a comprehensive options trading alert service that provides investors with real-time alerts, market analysis and insight from professional traders. The platform offers detailed analysis of the options market which can be used to identify potential entry points and exit strategies. In addition, Benzinga Pro offers detailed reports and trade recommendations based on actual trades as well as tips for improving your trading strategy. With its intuitive user interface, users can quickly access up-to-date news and data related to options markets and receive live updates on swing trades. Benzinga Pro is ideal for investors who are looking for an edge in the options market by leveraging the expertise of experienced traders combined with powerful analytical tools.

Benzinga Pro provides a powerful suite of tools to help investors make informed trading decisions in the options market. With its comprehensive analysis, real-time alerts and trade recommendations from professional traders, Benzinga Pro is the perfect choice for options traders looking to take their trading strategy to the next level.

Trading platforms and chat rooms are powerful tools for options traders looking to maximize their potential. These online environments provide investors with a comprehensive suite of analytical tools, real-time market updates, and access to experienced traders who can offer advice and mentorship. Additionally, trading platforms often offer portals to discuss current market conditions, share insights and strategies, or connect with other investors in search of the perfect trade. Chat rooms provide an ideal platform for novice traders to hone their skills by learning from experienced professionals and experts in the field. By leveraging these resources, investors can quickly identify entry points and exit strategies as well as acquire valuable insight into the financial markets and gain a competitive edge in the options market.

Trading Strategies and Basics of Options Trading

Options trading is an attractive investment option for those looking to leverage their capital in order to generate profits. Options trading requires traders to have a good understanding of the basics of options trading as well as a knowledge of different strategies and approaches. A trader must also be knowledgeable about entry prices, exit points, order types, risk management, and other key components of successful options trading. To maximize returns, it is essential that traders have access to resources such as research tools and alerts from professional traders who can provide guidance on the best entry and exit points for each trade.

Additionally, traders should be mindful of market sentiment and news developments in order to identify potential opportunities or pitfalls associated with each trade. By having a clear understanding of the basics of options trading as well as leveraging resources such as research tools, chat rooms, and professional alert services, investors can increase their chances of success in the markets.

Trade Alerts and Swing Trades

Trade alerts and swing trades can be an effective tool for those seeking to make profits in the options market. Trade alerts provide timely information on market movements and changes, allowing traders to capitalize on potential opportunities. When used properly, they can help traders make informed decisions while minimizing risk exposure. Swing trades involve taking a short-term position in an option with the intent of closing out the position within a few days or weeks.

These strategies allow traders to quickly capitalize on price fluctuations, allowing them to take advantage of short-term trends without having to maintain a long-term position in an option. Both trade alerts and swing trades can be beneficial for investors who are looking for quick profits or those who have limited capital resources but still want to take part in the markets. By combining both strategies with analysis of fundamental factors such as earnings reports, news developments and technical indicators, investors can maximize their chances of success in the options markets.

4. OptionAlarm

OptionAlarm is an options trading alert service that provides investors with real-time alerts and trade recommendations. The service monitors the financial markets 24 hours a day to detect opportunities for profitable trades. It also offers a range of strategies, from beginner to advanced, allowing traders of all levels to benefit from its insights. OptionAlarm’s experienced team of professional traders and analysts use proprietary algorithms and automated tools to monitor the markets and generate precise entry prices and exit points for trades. These alerts are then sent directly to your email or mobile device, allowing you to take advantage of lucrative opportunities as soon as they arise. While OptionAlarm is not suitable for everyone, it can be a great way for those looking to get into options trading without having to commit large amounts of capital or time studying the markets on their own.

OptionAlarm is a great way to jump into options trading without having to worry about large investments or spending time studying the markets. With their experienced team of professional traders and their precise entry prices and exit points, you can take advantage of lucrative opportunities as soon as they arise.

Professional Traders and Entry Prices

Professional traders often use proprietary algorithms and automated tools to detect opportunities for profitable options trades. This allows them to generate precise entry prices and exit points for their trades. OptionAlarm is a great service that takes advantage of this technology by providing real-time alerts and trade recommendations to its investors. The team of professional traders and analysts use these sophisticated tools to monitor the markets 24 hours a day, helping investors take advantage of lucrative opportunities as soon as they arise. With OptionAlarm, you can trust that the entry prices and exit points generated are highly accurate due to the advanced algorithms and technologies used by its experienced professionals.

Options Market and Profit Factor

Options trading is a complex form of investing that requires a deep understanding of the markets and various strategies. The options market can be highly volatile, with prices shifting quickly in response to market news or events. As such, there are often opportunities for traders to make quick profits from options trades. However, these trades come with a certain degree of risk, and it is essential for traders to understand the profit factor when making their decisions. Profit factor is an important concept to understand as it is essentially the ratio between successful trades and losing trades. By understanding this metric, traders can better evaluate the risk-reward profile of any potential trade and make informed decisions about their investments. By taking into account both the potential reward and the associated risks, investors can maximize their chances of success in options trading.

Trade Recommendations and Swing Trades

Trade recommendations and swing trades are two important concepts in the world of options trading. Trade recommendations refer to expert advice on which option trades to make. This advice can come from professional traders, investment advisors or even automated trading systems. Swing trades involve buying and selling an option at different points in the market cycle and are typically used when there is high volatility in the market. They are generally considered to be a more aggressive form of trading as they require quick decisions and a higher risk tolerance. Both trade recommendations and swing trades can be profitable, but it is essential for traders to understand the basics of options trading and devise a suitable strategy before executing any trades. Furthermore, relying on reliable sources for trade recommendations and staying up-to-date on financial markets news can help traders make informed decisions about their investments.

5. Investopedia Stock Simulator

The Investopedia Stock Simulator is an online tool that allows users to practice their trading strategies in a virtual stock market. It is designed to provide users with a realistic simulation of the stock market without the risk of real money. The simulator provides access to over 15,000 stocks and ETFs from 10 different exchanges including NASDAQ, NYSE, and AMEX. Users can also create custom portfolios for analysis, track real-time market data, view interactive charts, use technical indicators and apply complex options trading strategies. Furthermore, the simulator offers tutorials and educational resources such as videos and articles to help novice investors learn the basics of investing. With its user-friendly interface, comprehensive features and educational resources – the Investopedia Stock Simulator is one of the best options trading alert services available today.

The Investopedia Stock Simulator is an incredibly powerful tool to practice stock trading with no risk. With its comprehensive features, educational resources and user-friendly interface, it’s the ideal place to start your journey into the world of stock market investing.

Track Record and Investment Advice

Track record and investment advice are essential components to consider when exploring options trading alert services. A track record of success is a valuable indicator of trustworthiness, as it provides evidence of the service’s ability to consistently generate profits. Professional traders should have an impressive track record that spans several years and involves numerous successful trades. Additionally, the option trading service should provide users with comprehensive investment advice. This includes providing detailed financial market analysis, trade recommendations, entry price, exit strategies, and more. When evaluating options trading alert services, be sure to consider the track record and level of investment advice provided by each provider. Doing so will help ensure that you select a reliable option trading service that can deliver on its promises.

Financial Markets, Trade Recommendations, & Actual Trades

Financial markets are complex and ever-changing, often making it difficult for traders to stay on top of the latest trends and developments. This is why many traders rely on options trading alert services to provide trade recommendations and guidance. These services provide users with access to actual trades from experienced traders, allowing them to observe the strategies being used in real-time. Additionally, these services offer comprehensive financial market analysis that includes detailed insights into current trends, performance indicators, and more. By utilizing an options trading alert service, users can gain a better understanding of the markets and make informed decisions when making their trades. With the right service, users can increase their profits by capitalizing on opportunities as they arise.

Block Trades & Options Trades

Block trades and options trades are two important trading strategies used by professional traders. A block trade is an order to buy or sell a large quantity of securities in one transaction. Block trades are usually done at a fixed price, and they usually involve more than one security. Block trades can be executed as part of a larger portfolio strategy, or they can be done to take advantage of short-term market opportunities.

Options trades involve buying or selling options contracts on an underlying asset such as stocks, bonds, or commodities. Options contracts give the purchaser the right to buy (call) or sell (put) an asset at a specified price within a specified time period. Options trading requires knowledge of options strategies, timing, and risk management techniques in order to be successful. Professional traders often use options trading strategies in combination with traditional investments for greater returns.

Conclusion

All in all, there are a number of options trading alert services available to traders, each with its own unique set of features and benefits. The five listed here represent some of the best choices for those looking to take their options trading up a notch. Each service offers both entry price and exit guidance, as well as access to experienced professional traders and timely advice. Whether you’re looking for options trades or swing trades , or want to access an active chat room full of trading ideas, these services are sure to provide the resources you need to maximize your trading success. With the right combination of research, discipline, and sound investment advice, these options trading alert services can help you get the most out of your trades.